Example 3.5: Calculating Maximum Drawdown and Maximum Drawdown Duration

The continues the preceding long-short market-neutral example (Example 3.4.) in order to illustrate the calculation of maximum drawdown and maximum drawdown duration.

The first step in this calculation is to calculate the “high watermark” at the close of each day, which is the maximum cumulative return of the strategy up to that time.

(Using the cumulative return curve to calculate high watermark and drawdown is equivalent to using the equity curve, since equity is nothing more than initial investment times 1 plus the cumulative return.) From the high watermark, we can calculate the drawdown, the maximum drawdown, and maximum drawdown duration.

calculateMaxDD <- function(cumret) {

# initialise highwatermark to zero

highwatermark <- rep(0, length(cumret))

# initialize drawdowns to zero

drawdown <- rep(0, length(cumret))

# initialize drawdown duration to zero

drawdownduration <- rep(0, length(cumret))

for(t in 2:length(cumret)) {

highwatermark[t] <- max(highwatermark[t-1], cumret[t])

# drawdown on each day

drawdown[t] <- (1+highwatermark[t]) / (1+cumret[t])-1

if (drawdown[t]==0) {

drawdownduration[t] <- 0

} else {

drawdownduration[t] <- drawdownduration[t-1]+1

}

}

# maximum drawdown

maxDD <- max(drawdown)

# maximum drawdown duration

maxDDD <- max(drawdownduration)

return(c(maxDD, maxDDD))

}

# This is a continuation of exercise 3.4 and requires the netRet data

netRet <- readRDS(file.path(getwd(), "data", "netRet.rds"))

# cumulative compounded returns

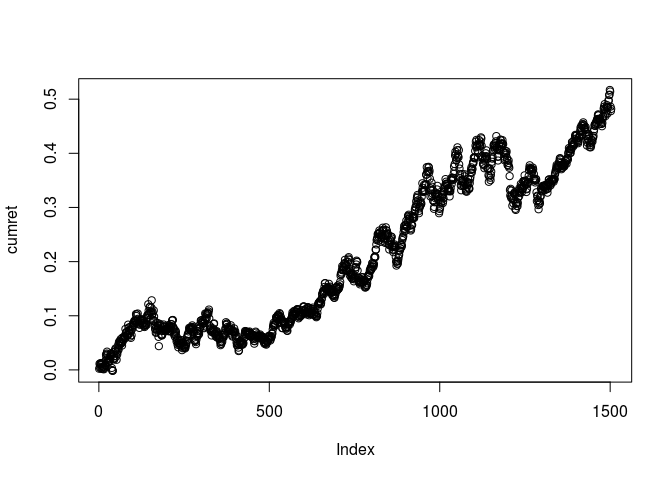

cumret <- cumprod(1+netRet)-1

plot(cumret)

# # maximum drawdown. Output should be 0.1053

# maxDrawdown

maxDrawdown <- calculateMaxDD(cumret)[1]

maxDrawdown

# # maximum drawdown duration. Output should be 497.

# maxDrawdownDuration

maxDrawdownDuration <- calculateMaxDD(cumret)[2]

maxDrawdownDuration

# Notice the code fragment above calls a function “calculateMaxDrawdown,”

# which I display below